Investment Banking and Transaction Advisory Services for Insurance Brokerages

We’re the leading advisor on the largest and most complex transactions in the insurance brokerage industry. Whatever transaction you’re pursuing, our comprehensive approach is proven to maximize value.

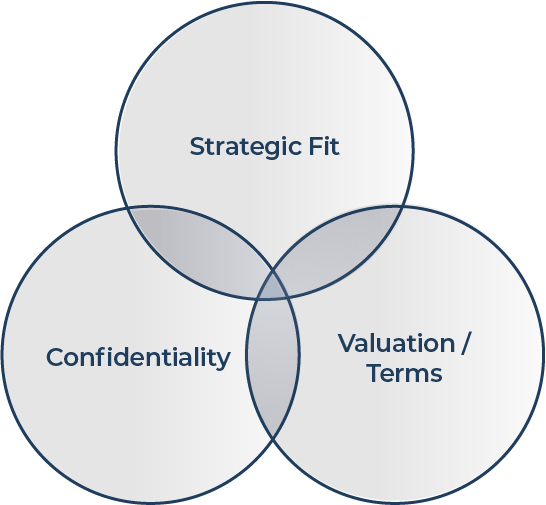

Our Sell-side Advisory Philosophy

The Reagan deal process is structured to maximize three areas:

The strategic fit between the seller and potential acquirer

The valuation/terms for the business purchase

The confidential nature of the discussions

These three areas are maximized by ensuring that we have a thorough understanding of the seller’s objectives and that we communicate clearly and consistently with the buyer community.

Sell-side Advisory

Navigating the M&A marketplace as a seller can be complicated.

Who are the right buyers to invite to the process?

What pro-forma adjustments can and should we make to our P&L?

How should we structure a deal?

How do we maximize our negotiating leverage and purchase price opportunity?

How do we ensure that our employees are taken care of in a transaction?

By leveraging our expertise in the insurance distribution system and our knowledge of the M&A marketplace, we provide a customized, high-quality advisory experience designed to help you answer all of these questions and more. We quarterback the entire process for you from beginning to end, guiding you through a transaction step by step so that you can maintain focus on your business.

We understand that a sell-side assignment generally represents the largest financial transaction in the lives of selling shareholders. We take the responsibility to advise on these deals seriously – focusing first on understanding a seller’s goals and transaction objectives in order to provide an advisory experience custom-built for each unique situation.

Buy-side Advisory

We’re a leading buy-side advisor in the insurance brokerage marketplace, representing banks, private brokers, and other buyers through every step of the acquisition process.

• Have you found a potential acquisition but don’t know what to do next?

• How should you price the deal? How should it be structured?

• What is the process?

We’ll act as your outsourced M&A team, guiding you through the deal with expertise, experience, and knowledge.

We’ve advised many of the nation’s leading privately-held firms on their acquisitions, building transactions that allow privately-held firms to be competitive while protecting shareholder returns.

As private equity investors and lenders have discovered our industry, brokers have more opportunities than ever to look outside their four walls for capital.

Private Equity interest in the industry has increased exponentially over the last 10 years. (Over 60 PE firms are already invested in the space or are currently seeking a new agency platform.)

Family offices (single and multi-family), viewed as long-term private capital, have begun investing in the space.

Local banks, industry lenders, and large financial institutions are active capital providers to agents and brokers.

The increase in capital availability has allowed brokers to be more creative with their capital structures. We’ve helped many of the industry’s leading brokers raise equity and debt capital so that they can simultaneously pursue growth investments and internal perpetuation. Raising capital can be a complex exercise, but completing the process can unlock new levels of growth and independence.

Debt & Equity Capital Raise

Mergers

For agencies that want to remain independent but also gain the benefits of increased scale, an expanded footprint, and enhanced capabilities, a merger may be the answer.

But a merger is a complex endeavor that requires not only compatible valuations but also agreements on many post-closing issues including organization structure, management roles, compensation arrangements, corporate branding, and many others.

We understand the art and science of mergers. We develop the valuations and transaction structure as well as facilitate the delicate negotiations and decision-making that accompany every merger. We are attuned to all the variables that matter in putting two or more agencies together so that the whole is greater than the sum of the parts.

Due Diligence

Buying an agency? Validate your assumptions and determine whether the deal is right for you.

You signed the LOI. What happens next?

Are the target’s pro forma financials reasonable and sustainable post-close?

How sophisticated are their management team and financial operations?

Can we start planning for integration prior to close?

If you’re looking to buy or sell an agency, you need a trusted partner on your side. We prepare industry-leading quality of earnings reports that identify key issues and verify that the proforma financials are realistic, so you have an M&A transaction that aligns with your expectations.

Our diligence team is well-versed in the industry’s agency management systems, accounting practices and M&A market trends—allowing us to discover, pre-close, things that might be problematic for you post-close.